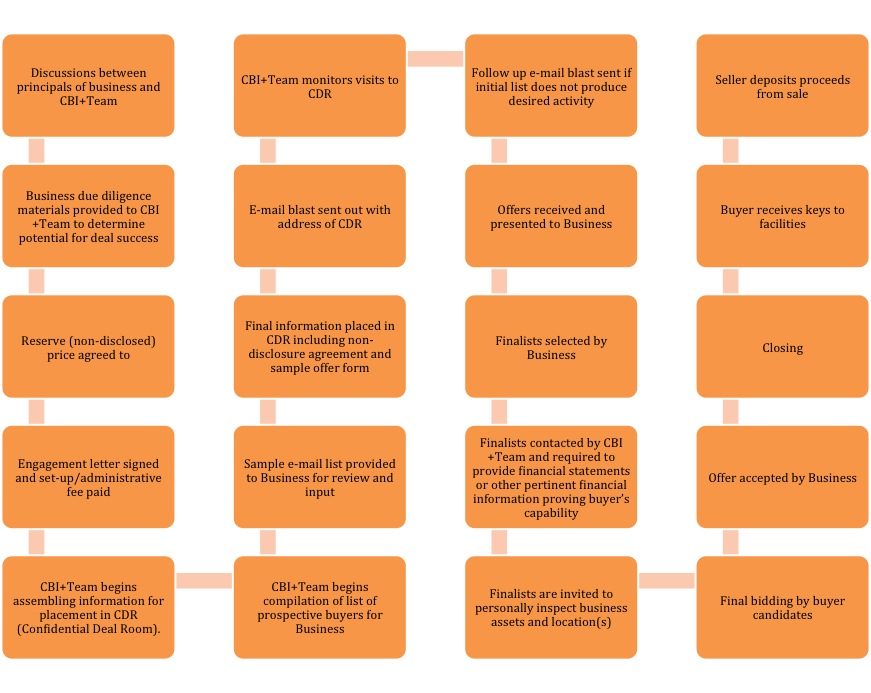

- Discussions between principals of business and CBI+Team

- Business due diligence materials provided to CBI+Team to determine potential for deal success

- Reserve (non-disclosed) price agreed to

- Engagement letter signed and set-up/administrative fee paid

- CBI+Team begins assembling information for placement in CDR (Confidential Deal Room).

- CBI+Team begins compilation of list of prospective buyers for Business

- Sample e-mail list provided to Business for review and input

- Final information placed in CDR including non-disclosure agreement and sample offer form

- E-mail blast sent out with address of CDR

- CBI+Team monitors visits to CDR

- Follow up e-mail blast sent if initial list does not produce desired activity

- Offers received and presented to Business

- Finalists selected by Business

- Finalists contacted by CBI+Team and required to provide financial statements or other pertinent financial information proving buyer’s capability

- Finalists are invited to personally inspect business assets and location(s)

- Final bidding by buyer candidates

- Offer accepted by Business

- Closing

-

Buyer receives keys to facilities

-

Seller deposits proceeds from sale

Northwest Arkansas

Central Arkansas

Fort Smith, Arkansas

www.cbiteam.com

www.cbicentralarkansas.com

www.cbiadvisorypartners.com

www.loans4biz.biz

www.tapbiz.biz

Tulsa, Oklahoma

Destin, Florida

Phone: (877) 582-5200

Fax: (888) 892-9995

E-mail: info@cbiteam.com